| |

Capitalism: Worldwide

PONZI Scheme |

< BACK |

rev. 8 May 2014;

rev. 14 September, 2013;

rev. 29 May,

rev. 15 April,

rev. 6 April,

rev. 20 March,

16 March 2009

My daily readings of the WSJ has helped me to reach the

following conclusion: The dominant economic system of the world,

i.e. Capitalism, is a Worldwide Ponzi Scheme.

Members of the western academic world have been legitimizing

this scheme with their "so-called scientific" research work. In

microeconomics textbooks[2], one can even find sections in which

the American academicians prove that a worse income distribution

(income inequality as measured by Gini coefficent) is better for

the poor in the long run, although in the long run we are all

dead!

WSJ-E authors and editors are very skillful in presenting all

the economic and financial facts and figures dispersed among

different articles and editorials in WSJ-E issues extending

several days and weeks (for which I am thankful to them). In

order to get the whole story, one needs to put together several

different articles and editorials published in different issues

of WSJ-E. Once you bring them together, the true story line

emerges.

WSJ-E authors and editors are very skillful in putting the blame

for any rising problem not onto the shoulders of the dominant

economic and financial system, i.e. Capitalism, but on the

individual misbehaviors, be it investors, professionals, rating

agencies, regulators, politicians and ordinary citizens. D.

Henninger (WSJ-E, 8 Jan 2009) calls the behaviors cataclysmic

behaviours. Although we read many examples of companies

being mugged by their executives, members of the Worldwide

Ponzi Scheme defend them with the following argument Honoring

contractual commitments is at the heart of what we do in the

insurance business (WSJ-E, 16 March 2009, p 31).

The Worldwide Ponzi Scheme has supporters in every

country of the world. If there arent any, the system creates

them by pushing the virtues of globalization and foreign (or

global, which is the preferred term) capital, a necessary

ingredient for limitless (?!)[3]

growth indefinitely (?!)[3]. WSJ-E is one of the covert and overt supporters of the

Worldwide Ponzi Scheme. The system avoids

discussing the disequilibrating effects of, e.g., capital

inflows of US $ 135 billion into Russian Federation in 2007 and

capital outflows of US $ 85 billion from Russian Federation in 2008,

because the system feeds itself on disequilibrium. Each and

every disequilibrium creates its own legal Ponzi Scheme.

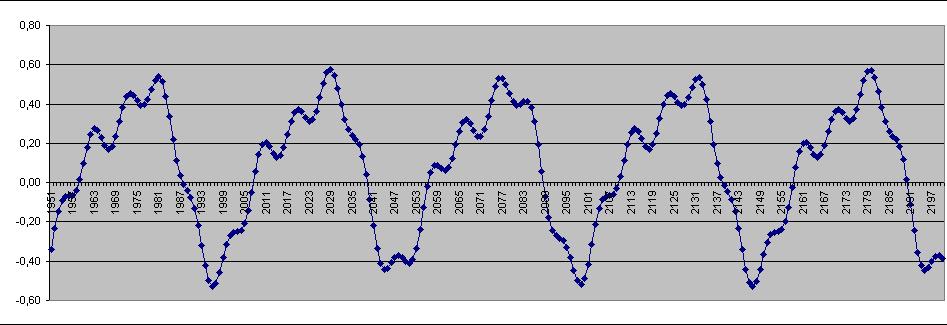

Examples of this "pump in - suck out" scheme can be found in

graphs drawn

using World Bank data.

Short-selling of equities is another form of legal Ponzi Scheme.

Andy Kessler (WSJ-E, 27-29 March 2009) explains: "In an

typical bear raid, traders short a target stock - i.e., borrow

shares and then sell them, hoping to cover or replace them at a

cheaper price. Once short, traders then spread bad news,

amplify it, even make it up if they have to, to get a stock

to drop so they can cover their short." The existing

mark-to-market accounting rules also help the raiders, not the

companies or banks!

World Gross

Product

was US$ 54.3 trillion in 2007;

The increase in

World Gross Product

between 2002 and 2007 should have ringed alarm bells at the

World Bank, IMF and governmental regulatory agencies. During the

same period

the size of the credit derivatives industry reached US$ 58 trillion

with no regulation; credit-default swap market size reached

US$ 27

trillion (WSJ-E, 19 March 2009) Andy Kessler

(WSJ-E, 27-29 March 2009) estimates the market size for credit

derivatives as US$ 62 trillion. Despite all these problems,

Mr Trichet of ECB didn't distance himself from his

longer-standing view that financial technology has been

beneficial for economic growth world-wide although he admits

that the interactions of perverse incentives, excessive

complexity and global imbalances, threw the credit boom into

reverse. (WSJ-E, 28 April, 2009)

Financial institutions and investors worldwide are reported to ultimately

realize US$ 2 trillion in losses on US loans, but recognized only half

of those losses so far (WSJ-E, 19 January 2009). I venture to

forecast that the actual figure will lie somewhere between US$

3.1 trillion and US$ 5.4 trillion.

Apparently, during the financial markets turmoil, stocks all over

the world lost US$ 30 trillion in value, whereas home equity

dropped US$ 11 trillion. But, we need to know the number of

transactions at each price level and compare them with the

original purchase price to determine the actual losses. Most of

the losses could be "paper-loss".

It is difficult to understand how governments and IMF and World

Bank do not see that the amount of free-floating financial

capital in 2009 is much larger than its amount in 1950 or 1970

or 1990! Size matters. Company size should be capped to get rid

of "too big too fail" cases. Maybe country size should be

capped, too!!!

"Big Bang" architects in UK are

questioning today the ideal of unfettered capitalism on

which it was built. Under former Prime Minister Margaret

Thatcher, a small group of officials, including Treasury chief

Nigel Lawson and Secretary of State for Trade and Industry Cecil

Parkinson, scrapped decades-old rules at the stock exchange and

other institutions. Looking back two decades later, Messrs.

Lawson and Parkinson say at least one thing went wrong: Banks

were allowed to grow too big for anyone, including their own

managers, to oversee. At the end of 2008, U.K. bank

assets amounted to US$ 11.31 trillion, ca. four times the

size of the UK economy (2008 GDP US$ 2.79 trillion)!! One sees that governments have little

choice but to bail them out when they get into trouble (WSJ-E,

31 March 2009). The case of Ireland is a perfect example,

where

the Irish government has guaranteed bank liabilities of US$ 632

billion,

more than twice GDP. (WSJ-E, 16-18 January 2009)

Governments are part of the Worldwide Ponzi Scheme

as the following stories tell us. The pharmaceutical company

Eli Lilly & Co agreed to pay US$ 1.42 bn to US Justice

Department to settle a probe into alleged improper marketing of

the antipscyhotic drug Zyprexa. (WSJ-E, 16 March 2009) UK

Financial Services Authority fined a unit of US Insurance Broker

AonCorp US$ 7.9 mn for weak controls on payments made overseas

that could be used for bribes in Bahrain, Bangladesh, Bulgaria,

Indonesia, Mynamar, Vietnam. (WSJ-E, 9 January 2009). Why are

US Administration and UK Government making money when US

companies misbehave?

Reading WSJ-E, I learned that

1.

countries hold US$ 11 trillion (US$ 12,2 tn March 2014) as central bank reserves, mostly

in US government papers;

Individuals in Turkey hold twice the Central Bank reserves as

US$ deposit. A naive estimate would claim that individuals in

all countries are holding US$ 22 trillion, or US$ 24 tn by March

2014..

2.

US government debt has reached US$ 11 trillion and expected to

reach US$ 13 trillion within 2 years.

3.

US government spends US$ 3 trillion in an economy of US$ 14.3

trillion (2008 GDP);

4.

there were 19 million empty houses repossessed by banks in USA at

the end of 2008;

Total commercial real-estate loans outstanding in USA at the end

of 2008 is ca. US$ 1.70 trillion.

5.

the financial products unit of AIG in USA holds US$ 1.6 trillion

derivatives portfolio (WSJ-E, 19 March 2009);

6.

the Japanese companies sit on US$ 1.5 trillion cash;

7. Government debt-to-GDP in Japan is

157 % according to Japanese government, but 180 % according to

OECD (WSJ-E, 1 April 2009).

8.

55 million vehicles were sold worldwide in 2007, 16 million in

USA; this figure dropped to ca. 13 million in USA in 2008 and expected

to hover around 9 million in 2009.

9.

Bank of America holds US$ 1 trillion deposits, which have probably

evaporated!

10

the private equity firms in USA have more than US$ 1 trillion

available for deal making (Guess whose money this could be!);

11.

US pharmaceutical and technology companies hold USD 250 bn in

cash and have US$ 220 billion debt.

The USA is at the apex of the Worldwide Ponzi Scheme.

Now, efforts are underway to add layers to the bottom of the

Worldwide Ponzi pyramide by luring Russia, China,

India and African countries into the scheme, if and only if, the

Worldwide Ponzi Scheme does not collapse before

this is realized. As of September 2013, household debt in China

is US$ 2.5 tn, corporate debt US$ 5.0 tn, government debt US$ 5 tn

with US$ 3.4 tn government reserves which reached US$ 4.0 tn by

March 2014.

Reshuffling world economy could put

another

country at the apex of the

Worldwide Ponzi Scheme,

which would probably be prevented from materializing by a war,

say around 2050!

________________________________________________

|